A bill tracker excel template is a great way to keep tabs on the progress of specific bills as they work their way through the legislature. By tracking a bill, you can stay up-to-date on what stage it is in, who is supporting it, and how you can contact your representatives to voice your opinion. There are many online bill trackers that make it easy for you to get involved.

If you want to be proactive about your personal finances, one great way to do so is to create a bill tracker. This will help you keep tabs on when your bills’ due date, how much you owe, and what payments you have made. A bill tracker is a tool that will allow you to monitor the status of your bills, in order to make payments at the time you need to. Tracking bills can help ensure that you are on top of your finances and won't run into debt.

Bill Payment Tracker - Excel Template and Digitally Fillable PDF INSTANT DOWNLOAD - Excel and PDF File

Stay organized with this simple, yet useful bill tracker template. Save hours of your time and reduce unnecessary stress related to piles of bills and late payments.

FORMAT INCLUDED:

- 2 SIZES: A4, US Letter Size (8.5 x 11 in)

- Digital format in Excel file - easily editable and can make multiple copy

- Available in Fillable and Printable PDF format - Fill in your computer or print it at home (high resolution files)

Bills to pay: List the bills you need to pay this month.

It can be daunting to look at a long list of bills and try to figure out how to pay them all. But, with a little bit of organization and planning, you can get through this monthly bill without too much trouble. The first step is to make a list of all the bills you need to pay this month. Then, rank them in order of importance, with the most important bill at the top. After that, take a look at your monthly budget and see how much money you have available to put towards your bills. Once you know how much money you have to work with, start paying your bills from the top of the list down. If you don't have enough money to cover a particular bill, try to come up with a plan for how you can pay it off over time.

Payments: Record when you make a payment on a bill.

When you make a payment on a bill, whether it is for your rent, credit card, or car loan, you are creating a record of that payment. This record can come in handy if there are any disputes about the payment in the future. It can also help you keep track of how much money you have been spending each month.

A bill tracker is a great way to keep your finances organized and ensure that you are never late on a payment. By tracking when your bills are due, you can avoid costly late fees. In addition, by keeping track of your expenditures, you can make sure that you are not spending more money than you have available each month. There are many different bill trackers available online, or you can create your own bill tracker spreadsheet. Here are a few tips for using a bill tracker:

- Make sure to update your bill tracker worksheet regularly. This will help ensure that you always have accurate information.

- Be proactive about payments. If you know that you will be short on cash next month, try to schedule some payments in advance.

- Use the tracker to create a budget.

You may also be interested in:

- Habit Tracker

- Birthday and Event Calendar

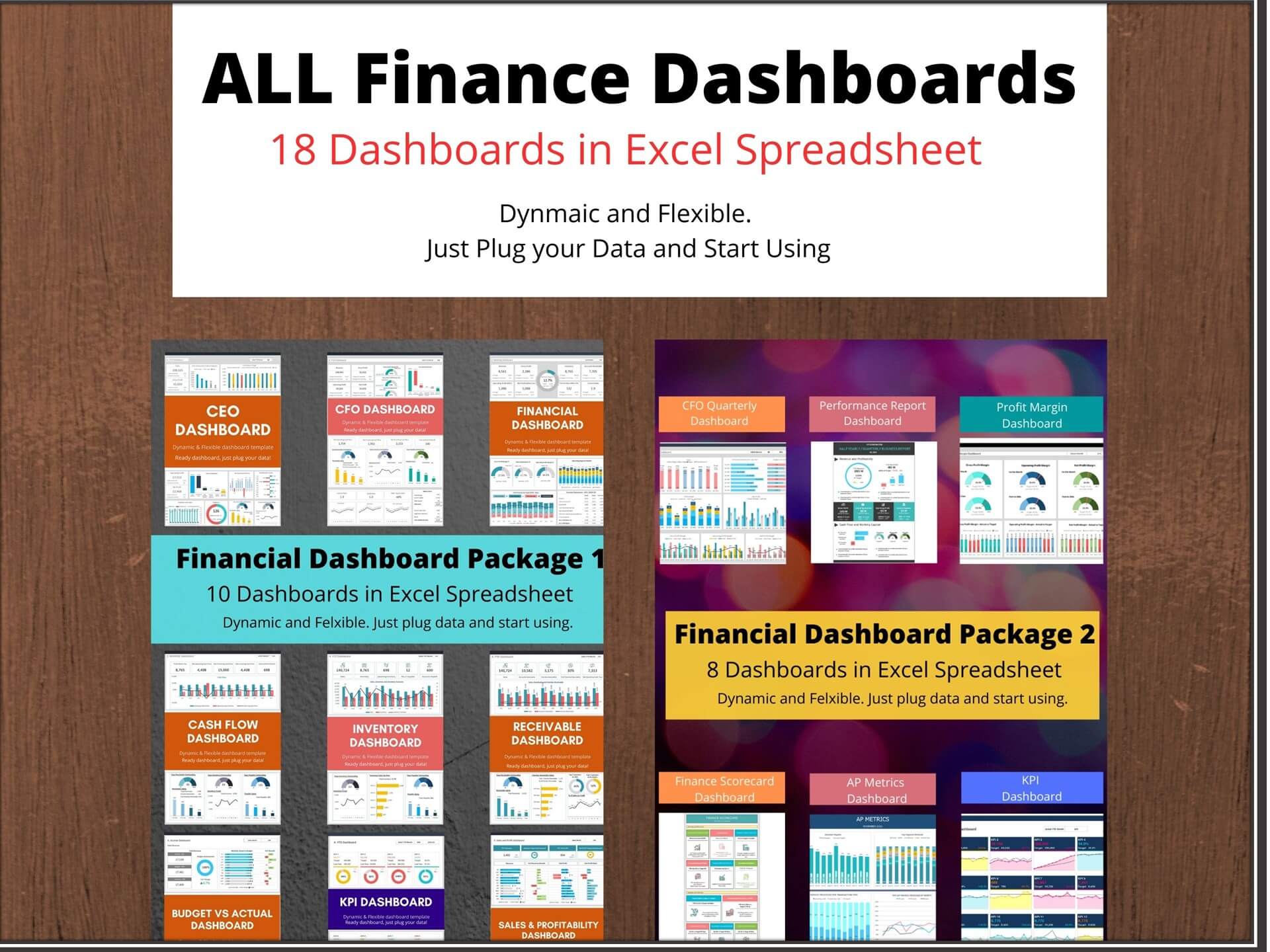

- Financial Dashboard Package

- HR Dashboard Package

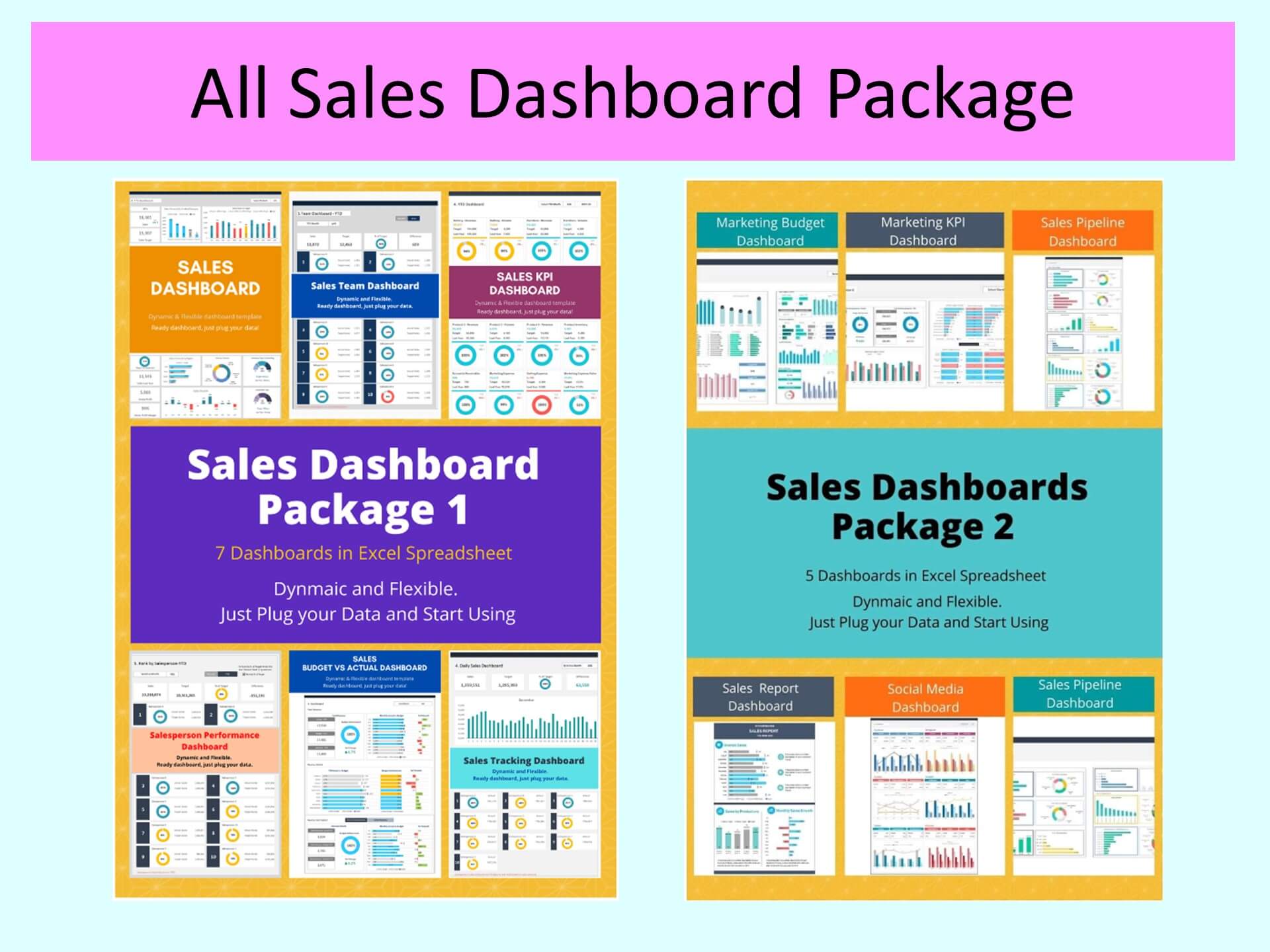

- Sales Dashboard Package