In today’s rapidly evolving business landscape, effective financial management is crucial for the success and sustainability of any organization. One essential aspect of financial management is budgeting, which enables businesses to plan, monitor, and control their expenses. With the advent of technology, budget management dashboards such as budget dashboards in Excel have emerged as indispensable tools for businesses. These interactive and user-friendly dashboards provide real-time insights into financial data, helping companies make informed decisions and achieve their financial goals.

In this blog post, we will explore the significance of budget management dashboards and why they have become essential for modern businesses.

Streamlined Budget Monitoring and Analysis

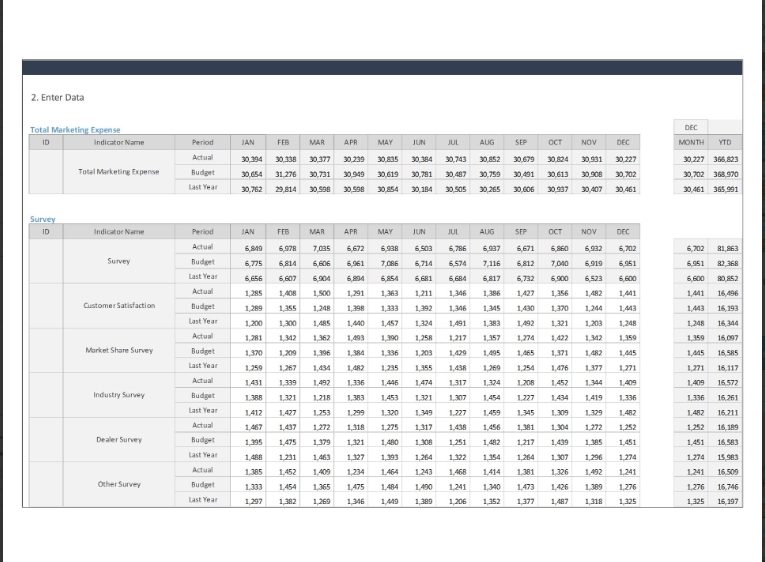

Budget management dashboards offer businesses a centralized platform to monitor and analyze financial data. Gone are the days of relying on manual spreadsheet-based budgeting, which was prone to errors and time-consuming. With budget management dashboards, businesses can automate their budgeting processes, streamline data collection and entry, and simplify analysis. These dashboards often integrate seamlessly with accounting systems, allowing for real-time data synchronization and updates. By consolidating financial information in one place, businesses can easily track their budget performance, identify trends, and make data-driven decisions promptly.

Enhanced Financial Visibility

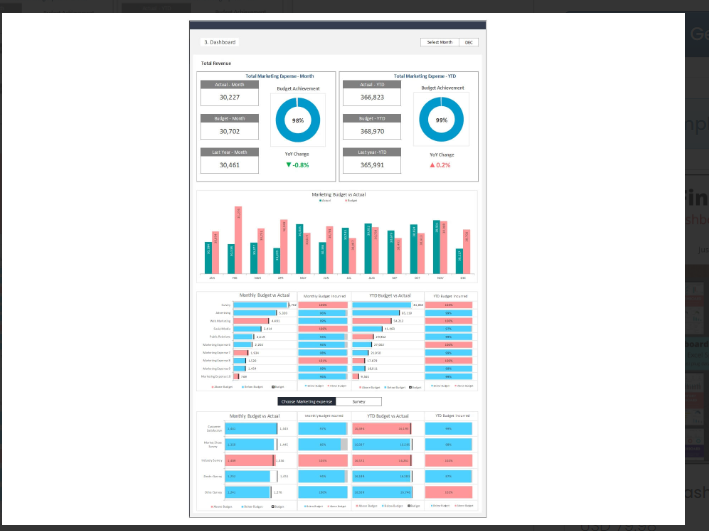

One of the key advantages of budget management dashboards is their ability to provide businesses with a comprehensive view of their financial health. Through visually appealing charts, graphs, and customizable reports, these dashboards offer a clear understanding of income, expenses, and overall budget status. Complex financial data is presented in a visually appealing manner, making it easier for CEOs, CFOs, and other stakeholders to grasp key financial insights quickly.

Whether it’s tracking revenue, monitoring expenses, or analyzing profitability, budget management dashboards provide real-time visibility into financial metrics, empowering decision-makers to take proactive actions and mitigate risks.

Real-Time Performance Monitoring

In today’s fast-paced business environment, timely information is essential for effective decision-making. Budget management dashboards enable businesses to monitor their financial performance in real-time. Key performance indicators (KPIs) can be set up on the dashboard to track critical financial metrics such as revenue growth, expense ratios, and profit margins.

With instant access to up-to-date data, businesses can identify areas of concern, detect budget variances, and take corrective actions promptly. Real-time performance monitoring helps businesses stay agile, adapt to market changes, and optimize their financial resources efficiently.

Improved Collaboration and Accountability

Budget management dashboards foster collaboration and accountability within organizations. These dashboards can be accessed by multiple stakeholders simultaneously, allowing teams to work together seamlessly. Budget owners can input their budget plans, actual expenses, and forecasts directly into the dashboard, ensuring accuracy and transparency. By providing a centralized platform, dashboards facilitate cross-functional collaboration, as teams can collaborate on budgeting, forecasting, and variance analysis. This promotes a sense of shared responsibility and empowers employees at all levels to contribute to the budgeting process effectively.

Effective Resource Allocation

Optimal resource allocation is crucial for maximizing efficiency and achieving business objectives. Budget management dashboards assist in allocating resources effectively by providing insights into spending patterns and resource utilization. By analyzing historical data and budget trends, businesses can identify areas of overspending or underspending and adjust their resource allocation accordingly. This data-driven approach enables businesses to align their budgets with strategic goals, identify cost-saving opportunities, and optimize resource allocation for better return on investment (ROI).

Effective Decision-Making Through Forecasting and Scenario Planning

Budget management dashboards empower businesses to forecast and plan for the future effectively. These dashboards enable scenario planning by allowing users to create multiple budget versions and compare them side by side.

Businesses can simulate various scenarios, such as best-case, worst-case, or most-likely scenarios, and evaluate their financial impact. By exploring different scenarios, businesses can make informed decisions, mitigate risks, and identify opportunities. The ability to perform forecasting and scenario planning within the dashboard provides valuable insights and helps businesses adapt to changing market conditions.

Improved Reporting and Communication

Budget management dashboards also enhance reporting capabilities and facilitate effective communication within the organization. These dashboards allow businesses to generate customized reports and presentations with just a few clicks, eliminating the need for manual data gathering and formatting. With visually appealing charts and graphs, businesses can present complex financial information clearly and concisely.

This simplifies the communication of financial results, budget updates, and key insights to stakeholders, including executives, board members, and investors. The ability to share real-time dashboards and reports with relevant parties ensures everyone is on the same page and fosters transparency and accountability.

Greater Efficiency

By automating various budgeting tasks and streamlining data collection and analysis, budget management dashboards contribute to significant time savings and improved efficiency. Instead of spending hours manually compiling and updating spreadsheets, employees can focus their energy and expertise on value-added activities, such as analyzing financial data, identifying trends, and developing strategic initiatives.

The automation and real-time nature of these dashboards eliminate the need for time-consuming manual calculations and reconciliations, reducing the risk of errors and enabling teams to work more efficiently. Ultimately, the time saved can be reinvested in other critical business areas, driving productivity and overall organizational performance.

Improved Scalability and Adaptability

Budget management dashboards offer scalability and adaptability, catering to the diverse needs and requirements of businesses. As companies grow and their financial operations become more complex, these dashboards can accommodate increasing data volumes and incorporate additional functionalities. Whether it’s adding new departments, product lines, or cost centers, budget management dashboards can be customized and expanded accordingly such as budget dashboards in Excel available easily on Biz Infograph. Additionally, these dashboards can integrate with other software applications, such as enterprise resource planning (ERP) systems or customer relationship management (CRM) platforms, further enhancing their functionality and providing a comprehensive view of business performance.

Better Security and Data Integrity

Data security and integrity are paramount in budget management. Budget management dashboards provide robust security features, ensuring that sensitive financial information remains confidential and protected. Access controls can be implemented, allowing authorized personnel to view and modify data based on their roles and responsibilities. By centralizing financial data within a secure platform, these dashboards minimize the risks associated with data breaches, unauthorized access, and data loss.

Moreover, with real-time data synchronization and automatic backups, businesses can have peace of mind knowing that their financial data is protected and can be restored in the event of an unforeseen incident.

Competitive Advantage

In today’s competitive business landscape, gaining a competitive edge is crucial for long-term success. Budget management dashboards can provide businesses with a significant advantage by enabling them to make informed financial decisions faster than their competitors. The ability to analyze real-time data, perform scenario planning, and quickly adapt budgets and strategies in response to market changes is invaluable.

Moreover, the enhanced reporting and communication capabilities offered by these dashboards allow businesses to present themselves as professional, well-managed, and financially sound, enhancing their reputation and credibility among clients, partners, and investors.

The Final Word

In conclusion, budget management dashboards have become essential tools for businesses to effectively manage their finances. With the ever-increasing complexity of financial data and the need for real-time insights, Budget template Excel management dashboards provide businesses with the necessary tools to stay competitive, make informed financial decisions, and drive sustainable growth.

Investing in a robust budget management dashboard, such as Biz Infograph’s budget dashboard in Excel, is no longer a luxury but a necessity for businesses aiming to thrive in today’s dynamic and challenging business environment. Visit our website today and check our range of budget management dashboards and budget Financial Dashboard Templates in Excel. Get started today!